About Bitex

Bitex hopes to be ready when the time comes to become the first embedded embedded encrypted bank. It aims to provide financial services to digital economics based on electronic money that are relevant and useful to the local customer base in each area where it operates when available. global. Bitex will provide digital money-based banking services to digital customers through a licensed technology platform available to local partners.

Bitex believes it can make the greatest impact on society by working at the local level, and ensuring that the benefits of this new electronic money-based economy are also possible. felt by those who have not been served or abandoned from the current banking system. So instead of starting right away as a global bank, Bitex wants to ensure that the solution has a local impact.

BITEX will provide super-local banking encryption services through its global platform to drive growth on various continents, focusing on Asia. Different cultures depend on their banks - local strategies that allow for more centralized and computational decisions. Companies that use traits as long as banks offer, such as partnerships and community development in the presence of locales and combine them with the benefits and efficiency of the blockchain distribution.

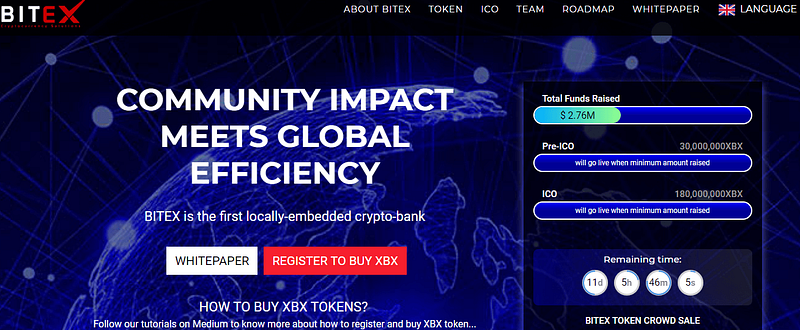

Bitex XBX Token

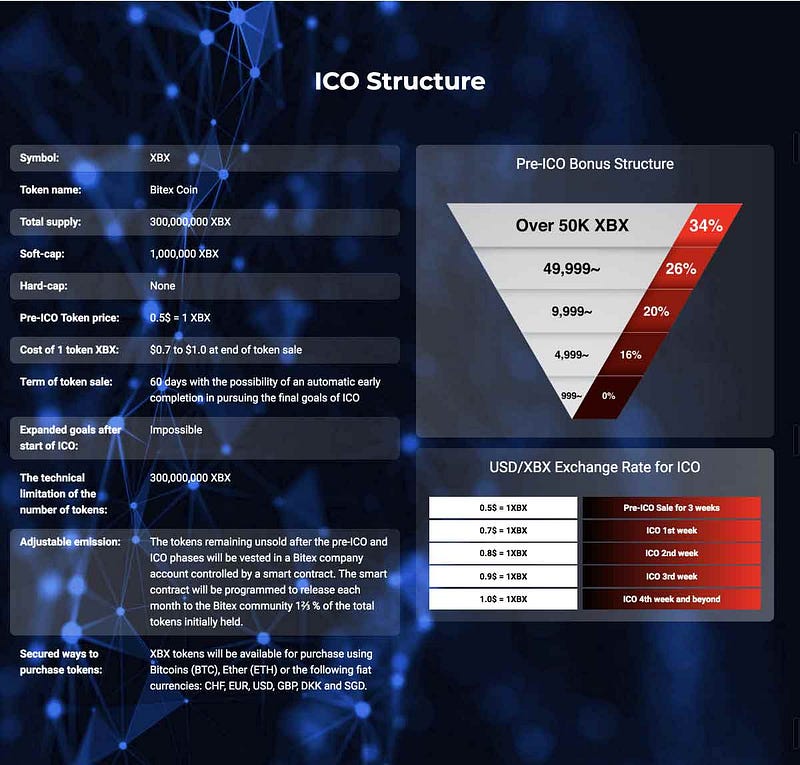

Bitex conducts a Coin Coin Offer on its utility Token, Bitex Coin with the XBX logo, to promote the use of the brypto-brypto-banking platform. XBX will be used to access services provided by the Bitex platform. After ICO, tokens will be available for purchase from other XBX Token holders on the Bitex exchange platform and other well-known encryption exchanges. Bitex will demonstrate local impacts in each country where licenses provide local financial service packages and redefine how financial services for the digital economy are based on this new electronic money platform.

Although there are many shareholders in the cryptographic banking space, Bitex hopes that this supra-local strategy will provide benefits in creating, over time, global encrypted banking. for main consumers. Each transaction on the EZBitex platform will be charged a transaction fee of a percentage of the transaction value, calculated in XBX at the current exchange rate for conversion on the EZBitex platform. EZBitex-based transaction costs include conversion of fiat and electronic money, electronic money pairs, payments (by sellers) to B2C and electronic money transfers.

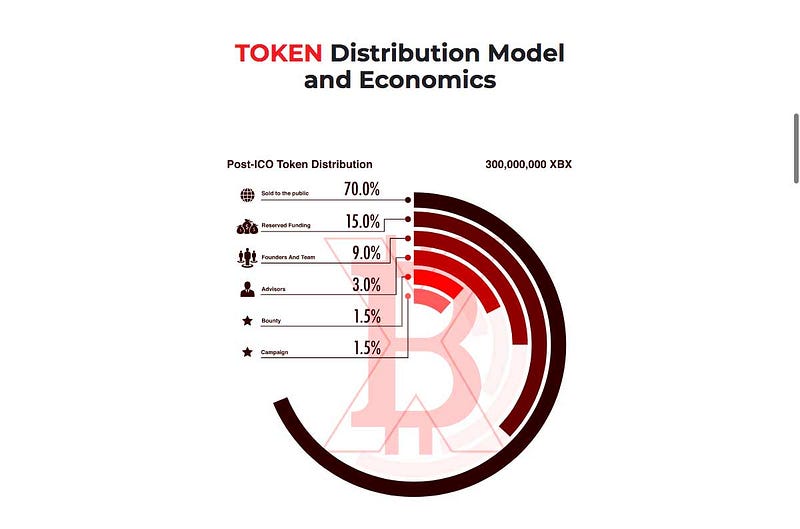

Share tokens

70%

Sales Token

15%

backup

9%

Founder

3%

Advisor

3% Bonus

Service for customers

Bitex customers will be able to take advantage of services such as banking (payments, currency exchanges and wire transfers, debit cards and personal loans) that will be offered in eight original countries.

In particular, consumers will be able to take advantage of the following services.

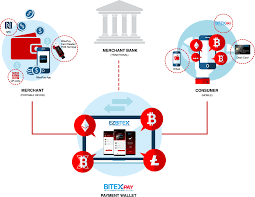

Payment

BitexPay represents services that Bitex provides to consumers and sellers to pay for goods and services using electronic money. The seller will be able to accept payments in electronic currency or fiat according to their choice. Consumers who enter the BitexPay solution will be provided with compatible ERC-20 wallets containing their electronic money assets. Initially, Bitex will only support the following electronic money: BTC, ETH, and LTC and Bitex Coin, XBX. When EZBitex exchange of new currencies has been added, consumers must be notified of the availability of this type of money via mail or social media.

Trading

Consumers who want to trade electronic money using the EZBitex exchange editing service will enter the wallet associated with their account. The encrypted account in this wallet can be used for margin trading, transaction limits, leverage, etc. Consumers who participate in transactions will pay transaction fees in the electronic currency they sell. while fiat currencies will be converted to XBX at the current market price on the EZBitex trading platform.

Foreign exchange

Exchange all in one EZBitex will provide conversion from password to password, from fiat to password and vice versa, or from fiat to fiat. The cryptocurrency that will be registered will be added over time, with notifications made to consumers via email and social media.

Lurking

To encourage the use of the Bitex platform, consumers will be rewarded with an XBX Token. The number of XBX tokens managed by consumers on the EZBitex platform will be stored in the wallet. Prizes will be in the form of discounted transaction fees for exchanging electronic money. As long as the customer has risked the appropriate amount, the customer will automatically receive the discount quoted in the transaction fee independent of profitability or expand the EZBitex platform.

Loan

Consumers want to get a loan from Bitex by providing electronic money as collateral that will be provided with a wallet. This wallet maintains the loan status and returns it.

Service for sellers

All sellers must go through the Bitex Know-Your-Customer (KYC), Money Laundering (AML) and Bitex (CBB) processes before registering for a merchant account. Once registered, the seller's location will be added to our GPS positioning server so that customers can find a CBB verified trader for our services.

BitexPay

Sellers can provide payment options to buyers of their goods or services using the BitexPay mobile application or for those who display physical cards, through a reader or BitexPay device. Terminal Point of Sale.

Buy online

Online merchants will be provided with an integrated payment gate provided by Bitex, which allows traders to accept BitexPay cards for purchases. Transactions will be sent to this EZBitex platform for approval and payment.

Business to pay

The EZBitex platform will provide a payment gateway through which traders or businesses with Bitex accounts can pay for their respective goods and services. This payment service will function globally. Sellers / traders who want to pay for goods or service providers can make invoices or request payment as a QR code or link shared with the recipient of the payment. This invoice also contains information similar to that used in traditional cross-border banking payments including the purpose of payment and registration details and taxes from both parties. The link on the invoice will direct the payer to the payment page on the EZBitex portal where the details are confirmed.

Benefits

Consumer

The Bitex Banking Encryption Solution requires consumers to maintain their own electronic wallets on their mobile devices. There is no private key for this wallet that is shared with the EzBitex platform. Decentralized way to store other Bitex customer wallets and only use the necessary platform will allow Bitex to ensure that customer assets are safe from attacks or other attacks. . With that, Bitex will develop code codes and use PCI Certification for security in the near future. Personal e-wallet, mobile banking solutions make Bitex encryption widely available,

Government

Funds collected at the ICO will be carried out by shareholders of local licensed companies in each country where Bitex will operate. Local companies will be registered in each country where Bitex will operate, with the company obtaining the license needed to operate as a local cryptographic bank. Shareholders hold more than 50% of the shares of local companies can choose on the guidelines made and use the funds collected at the ICO.

ong - co-author of the UAE

Team

Harith Motoshiromizu - CEO

Nicolas Louis Laurent Berthoz - Chief Financial Officer

Mr.Junjiro Sato - CIO

Ryan La France - Chief Financial Officer

Mr. Yusuke Asai - CPO

Mr. Suparat Damrongsuttip

All contact information:

Website: https://ico.bitex.global/

Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

Twitter: https://twitter.com/bitex_global

Telegram: https: / /t.me/joinchat/IV2i4Q6llH7ttm5n9hqT5g

Facebook: https://www.facebook.com/bitex.global/

https://bitcointalk.org/index.php?action=profile;u=1299546

Whitepaper: https://ico.bitex.global/docs/XBX-Token-WhitePaper.pdf

Twitter: https://twitter.com/bitex_global

Telegram: https: / /t.me/joinchat/IV2i4Q6llH7ttm5n9hqT5g

Facebook: https://www.facebook.com/bitex.global/

https://bitcointalk.org/index.php?action=profile;u=1299546

fatimahzahra : https://bitcointalk.org/index.php?action=profile;u=1743266

Tidak ada komentar:

Posting Komentar